Wells Fargo IBAN: What You Need to Know Before Transacting Globally

Wells Fargo IBAN: What You Need to Know Before Transacting Globally

For millions navigating cross-border payments, understanding the role of the IBAN under the Wells Fargo umbrella is essential—but rarely intuitive. Whether transferring funds, opening a internacional account, or managing international expenses, the IBAN (International Bank Account Number) serves as a digital gateway to seamless financial connectivity. With Wells Fargo’s integration of IBAN standards into its global banking services, users demand clarity on how this number functions, why it matters, and what safeguards are in place.

This comprehensive guide breaks down everything from format and regional variations to security privileges and common pitfalls—empowering customers to use their Wells Fargo IBAN with confidence.

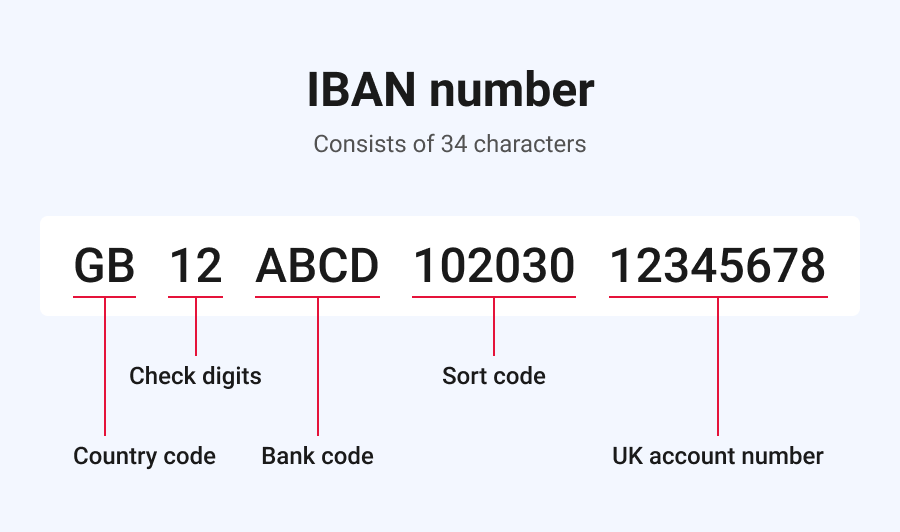

The IBAN under Wells Fargo follows the standardized international format, ensuring compatibility across European and select global banking systems. Typically, it consists of 34 characters: two letters representing the country code (e.g., "DE" for Germany, "FR" for France), two digits for the financial institution identifier, followed by six digits, and a final 25-character bank account number.

This structure—formal and precise—enables automated clearing and reduces processing errors. As Wells Fargo specifies, any IBAN bearer must conform strictly to this international schema to be accepted by its transaction networks.

Regional Variations: How IBANs Differs Across Countries Served by Wells Fargo

While the core principles of IBAN remain consistent, regional adaptations reflect national banking traditions. Wells Fargo’s IBAN functionality integrates these nuances, tailoring formats to country-specific rules.For instance, in Germany, Wells Fargo’s IBAN generally includes a check digit at the end—computed algorithmically to validate accuracy—while in France, the format incorporates a mandatory 2-digit institution code separated from the national IBAN segment.

Key Differences by Country

- Germany & Austria: GL (General Ledger) IBANs — Represented as DExx.xxxxxxxxxxx.xxx, where the first two letters denote the delegate bank. Wells Fargo treats these as domestic master IDs, enabling swift domestic and EU cross-border transfers. - France: ISO-Code + 2-Plus Key — IBANs begin with FR, followed by a 2-digit efficient branch code, then the national account number.Wells Fargo systems automatically validate these structure rules during international wire initiations.

- United States (for select operations): EDN Format — Though Wells Fargo’s primary global focus is Europe, its U.S. international arm supports EDN (Electronic Drivers’ Number) mappings alongside standard IBANs for unique logistical accounts. This dual format enhances flexibility for clients managing multi-jurisdictional funds. These regional distinctions ensure that each IBAN is optimized for seamless domestic and cross-border settlement within its banking zone—no manual adjustments required.Why Wells Fargo Emphasizes IBAN Accuracy and Security Wells Fargo integrates advanced fraud detection and compliance protocols directly into its IBAN transaction workflows. Every IBAN entry undergoes validation against real-time database checks, confirming country codes, financial institution identifiers, and account number integrity. This safeguards against misuse, identity theft, and routing failures.

According to Wells Fargo’s official documentation, “Accuracy in IBAN entry is non-negotiable—errors can delay transfers or result in funds being sent to unintended recipients.” The bank employs multi-layered validation:

- Automated syntax checks that verify character count and alphanumeric composition

- Cross-referencing with institutional master data to confirm account legitimacy

- Real-time integration with SWIFT and SEPA networks for immediate status feedback

Primary Uses of Your Wells Fargo IBAN

The IBAN held with Wells Fargo serves as a foundational element across multiple financial operations:- International Wire Transfers—Essential for sending or receiving cross-border payments, from payroll disbursements to business treasury operations.

Wells Fargo’s IBAN enables direct debiting and crediting across EU SEPA zones and selected global corridors.

- Single Euro Payments Area (SEPA) Compliance—Wells Fargo IBANs automatically comply with SEPA directives, allowing seamless euro transactions without currency conversion fees within the zone.

- Foreign Account Management—To open or manage non-U.S. bank accounts linked to Wells Fargo, the IBAN acts as a primary banking identifier, streamlining account verification and future transaction setup.

- Automated Bill Payments & Recurring Payments—IBANs facilitate set-up of recurring transfers for utilities, subscriptions, or vendor settlements, reducing manual processing and error risks.

Common Pitfalls and How Wells Fargo Prevents Errors

Despite its precision, IBAN misuse remains a frequent source of banking delays.Common mistakes include transposing digits, omitting check digits, misassigned country codes, or entering invalid bank identifiers. Wells Fargo addresses these risks through a combination of education, technology, and policy enforcement. Key preventive strategies include: - Real-time syntax validation: entered during IBAN creation blocks invalid formats before transmission.

- Region-specific guidance: customers receive tailored instructions based on the intended country, highlighting local quirks like Germany’s check digit. - Automated back-end verification: once submitted, well before funds leave the system, Wells Fargo’s fraud engines validate the IBAN against its institutional database. - Customer alerts and support—automated notifications warn of potential errors, while dedicated support teams assist with exceptions, minimizing settlement hold-ups.

Users are repeatedly advised to double-check every character, especially country codes and numbers, before initiating any cross-border transaction.

Setting Up and Managing Your Wells Fargo IBAN: A Step-by-Step Guide

Establishing a Wells Fargo IBAN is straightforward but requires attention to detail. Whether opening a multi-currency account or connecting an existing international account, Wells Fargo offers clear pathways.- Open a Wells Fargo International Account: Complete the application with full bank details, including the country code and branch-specific identifiers required to generate a valid IBAN. Wells Fargo typically supplies IBAN templates post-approval.

- Receive Your IBAN: Upon approval, your unique IBAN is delivered via secure email or via the Wells Fargo private online portal—never via unencrypted email.

- Confirm and Input with Precision: Always verify the number against official statement docs before use. Duplicate characters or missing segments risk failed transfers.

- Utilize Ready-Made Formats: Wells Fargo provides downloadable IBAN templates tailored to your home country, simplifying input into partner networks.

Wells Fargo also supports recurring updates if account codes change, ensuring long-term reliability.

The Future of IBAN Standards in Global Banking: What Wells Fargo Is Preparing For

As global finance evolves, so too does the framework underpinning IBANs. Regulatory shifts, digital identity advancements, and real-time payment ecosystems are reshaping cross-border transactions.Wells Fargo is actively investing in next-generation payment rails, ensuring its IBAN infrastructure remains compatible with emerging technologies like instant SEPA credit transfers and blockchain-based settlements. According to Wells Fargo’s internal financial technology roadmap, “We are integrating enhanced digital identity verification with IBAN processing—blending biometrics, AI anomaly detection, and secure tokenization to redefine how IBANs authenticate and authorize global transactions.” This forward-thinking approach ensures that while the core IBAN format endures, its application grows smarter, faster, and more secure.

Understanding Wells Fargo’s IBAN system reveals more than logistics—it reflects the bank’s commitment to enabling frictionless, secure international finance.

From precise formatting rules to robust fraud safeguards, every element is engineered around reliability. For anyone relying on global transfers, this knowledge transforms potential complexity into confidence—making each IBAN a key to trusted, worldwide economic participation.

/what-is-an-aba-number-and-where-can-i-find-it-315435_final-5b632380c9e77c002c9ef750.png)

Related Post

Who Are the Stars Behind the Carshield Commercial’s Rise to Stardom?

How Cloudfront Transforms Global Content Delivery with Lightning-Fast Speed

Paul Reubens: Peewee Herman’s Velocity Icon Dies at 70, Ends a Pub Crawl With Legacy That Endures</h2> In a twilight marked by both cinematic memory and untold facets of his life, Paul Reubens, the man behind the slobbery, eccentric, and outspoken Peewee Herman, passed away at 70. Known for redefining childhood rebellion on screen, Reubens’ death closes a chapter in American pop culture, one that blended vulgar humor with heartfelt authenticity. Once a household name from the 1980 hit film, his legacy extends far beyond the red-and-white striped shorts, now inseparable from the character who captured a generation’s cantankerous charm. <p>Born in Baltimore, Maryland, in 1952, Reubens emerged not just as an actor but as a performer unafraid of pushing boundaries. His embodiment of Peewee Herman—a defiant, snarly-haired antihero—blended physical comedy with sharp, streetwise dialogue that struck a chord with audiences hungry for authenticity. The Peewee Herman series, though commercially successful, often overshadowed Reubens’ broader artistic range. Few realize he appeared in Broadway plays, voice acting, and even avant-garde theater, proving his talents extended well beyond children’s television. As *Chicago Sun-Times* noted in its obituary, “Reubens was more than a child star—he was a performer who leveraged innocence into subversion.” <h3>A Career Built on Risk and Voice</h3> Reubens’ early career was defined by bold choices. Before Peewee, he starred in off-Broadway productions such as *The Spook Who Sat by the Door*, where his dramatic range simmered beneath the surface, hinting at complexity beneath the goof. With Peewee Herman, launched in 1985, he abandoned subtlety entirely: “Make them laugh, make them weird, make them remember,” Reubens once said, capturing the essence of his performative philosophy. The character’s signature voice—raspy, gravelly, dripping with sass—became iconic, a vocal signature recognized by millions. <p>The 1980s explosion of Peewee Herman’s films turned Reubens into a curious cultural paradox: a serious actor whose most beloved role was pure absurdity. Yet, in interviews, he insisted his performance was deliberate—a nuanced portrait of teenage defiance. “I didn’t play a cartoon character,” he explained. “I played a version of me—rough around the edges, protective of friends, screwed up, but loyal.” This authenticity resonated in an era increasingly skeptical of artificial corporate branding, making Peewee’s appeal timeless. <h2>Personal Life and Shadows Beyond the Spotlight</h2> Beyond the screen, Reubens navigated a life marked by both acclaim and private complexity. Always a confessed fan of rock ’n’ roll and jazz, his persona extended into music and visual art, though these pursuits rarely entered mainstream discourse. He resided in New York’s Greenwich Village, a neighborhood steeped in artistic tradition, maintaining long-standing friendships with peers across disciplines. <p>Despite the glare of fame, Reubens valued privacy fiercely. The Velvet Crimeoclub — a performance space and cultural hub — served as a sanctuary where he entertained trusted artists and writers. In rare public appearances, he spoke candidly of battling creative stagnation and the weight of typecasting, once remarking, “People remember the mask, not the man.” Such reflections humanized the performer, revealing layers beneath the red-and-white attire. <h3>Leadership, Mentorship, and the Legacy of Peewee</h3> Reubens’ influence reached beyond performance into mentorship. He supported emerging artists through workshops and collaborative projects, particularly those exploring boundary-pushing storytelling. The Peewee Herman Archive, now studied in theater programs, illustrates how he transformed personal quirks into universal themes of identity and belonging. <p>The character became a cultural touchstone, symbolizing youthful rebellion and resilience, but Reubens resisted reducing himself to a symbol. “Herman isn’t me,” he clarified in *Sun-Times* features, “he’s a story I inherited—and a story I continue telling, oddly enough, decades later.” This duality—public icon, private craftsman—defined his enduring presence. <h2>Enduring Impact: Why Peewee Herman Still Slaps the Nerve</h2> Even after the curtain fell, Peewee Herman retains pulse in internet memes, fashion revivals, and genre homages. His snarl, “You ya ridiculous—bury me!” echoes in viral clips and social commentary. Yet Reubens’ true legacy lies not in viral fame but in the authenticity he brought to every role. <p>Critics and fans alike praised his ability to fuse humor with emotional truth. As theater historian Dr. Elena Park observed, “Reubens taught audiences that vulnerability and absurdity coexist. He made slobberness feel sincere.” Whether in a Intervals show, a Broadway curtain call, or a private art session, Paul Reubens remained fundamentally creative—too often typecast, never fully understood. <h1>Paul Reubens, Peewee Herman’s Velocity Icon Dies at 70 — Ends a Velocity Legacy That Never Grew Old

Glenis Duggan Batley Unveiling The Story Of A Remarkable Life